CONSUMER PRODUCTS

Finishes, Tools, and Power Equipment

World's Most Productive Companies

Durable Goods in a Disrupted Housing and Construction Cycle

The companies in this peer group are all participants in the manufacturing and distribution of durable goods, primarily focusing on tools, home improvement products, outdoor power equipment, and building materials. Their common ground lies in serving a mix of professional tradespeople and do-it-yourself (DIY) consumers. Key product categories include power tools, hand tools, plumbing and security products, as well as equipment for outdoor use. They share a reliance on complex global supply chains and are heavily influenced by the health of the construction and housing markets, as well as brand recognition.

Major market influences included a significant pandemic-driven surge in DIY demand, substantial supply chain disruptions and inflation, the rapid shift to advanced battery-powered products, and the accelerating penetration of e-commerce, which required increased digital investment. Productivity has been impacted over the last six years due to supply chain volatility, causing production inefficiencies, labor shortages, the operational complexity of managing new e-commerce channels, and short-term disruptions from heavy investments in new product development and automation technologies.

Top 100 World's Most Productive Companies - Finishes, Tools, and Power Equipment

Productivity Snapshot

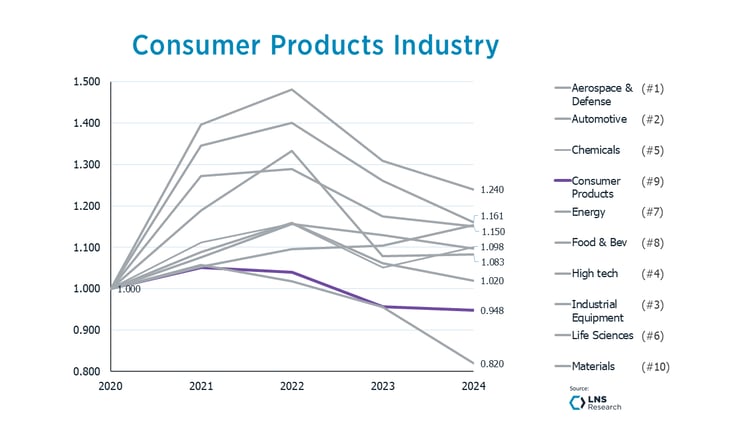

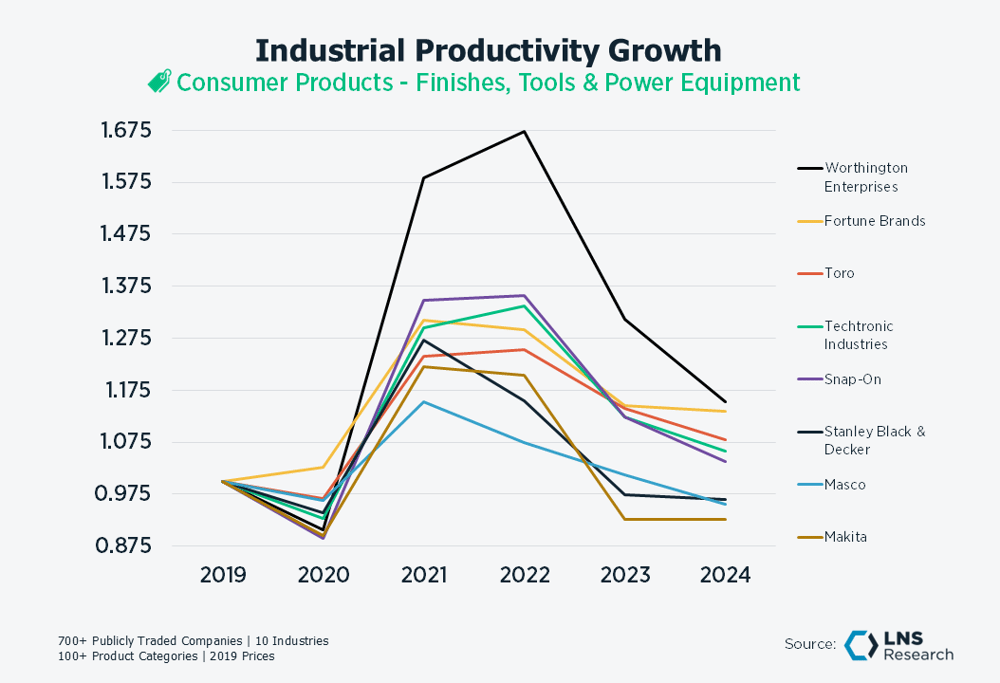

The peer group experienced a similar productivity trend to many other industries and peer groups: a surge in productivity from 2020 to 2023, followed by regression and stagnation in 2023 and 2024.

The scale of the “COVID bump” in demand exacerbated the volatility compared to other Consumer Products peer groups.

- Productivity for the sector grew overall by 3.8% (or less than 0.8% per year) over the last six years. This sector, like Consumer Products generally, performed well below the average for manufacturers represented in the IPI, with less volatility in its productivity performance.

- All eight companies in this peer group experienced negative productivity growth in 2023 and 2024.

- In 2024, Productivity declined an average of 5.6% across these companies.

- Worthington Enterprises Inc. earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity 15.2% over the last six years, four times the average of its peers/competitors. Worthington is another example of a key finding in the IPI data: spinouts of larger corporations have demonstrated a real ability to increase productivity compared to their peers. Worthington’s leading productivity performance is driven by streamlining operations post-spin-off, leveraging a long-standing "people-first" culture that fosters high employee engagement and superior safety performance, and investing in transformational technology (AI, people-sensing forklifts) to effectively integrate it into daily work processes.