Tier 1 Systems Integrators

World's Most Productive Companies

Strained Systems: Integrators Face Growth Bottlenecks

Tier 1 Major Systems Integrators derive meaningful revenue from government, defense, security, and aerospace programs, often as major subsystem providers. Most carry large multi-year backlogs tied to the U.S. Department of Defense/War, as well as allied Ministry of Defense, and several also serve the civil aerospace and public safety sectors.

Over the last six years (2019–2024), these companies have faced a significant civil aviation downturn and recovery from COVID-19, supply chain constraints, and inflation, as well as a sharp global rise in defense spending following Russia’s 2022 invasion of Ukraine. Space activity and small-satellite demand expanded launch and space-systems markets, though small-launcher competition remains intense. As with the Global Primes, the surge in defense spending has outpaced supply capacity, so these companies are working diligently to expand their capacity in an era of labor shortages and supply chain challenges.

In 2024, the productivity of all these companies declined as the Red Sea reroutes increased logistics costs and extended lead times, necessitating significant retrofit or inspection workloads on various programs. Efforts to increase capacity struggled to meet surging demand for defense and space.

Top 100 World's Most Productive Companies - Major Systems Integrators

Productivity Snapshot

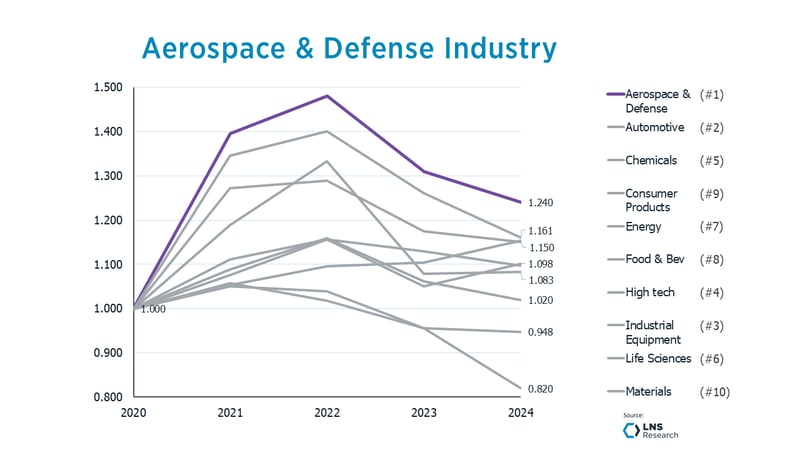

Despite the long-term nature of this market and these businesses, the Major A&D OEM’s saw a similar productivity trend as many other industries: a surge of productivity from 2020 to 2023, but a regression to declining productivity in 2023 and 2024.

- Productivity for the sector grew overall by almost 13% over the last six years. This segment, like A&D generally, performed well above the average for manufacturers represented in the IPI but has returned to stagnation and regression over the last two years.

- All these companies had overall negative productivity growth across the last two years.

- 2024 Productivity declined an average of 6.2% across this peer group.

- Leonardo DRS Inc earned its position on the LNS 2025 World’s Most Productive Companies by growing productivity 24.1% over the last six years, 98.3% more than the average of the Peer Group. Leonardo DRS’ productivity performance is driven by focusing on high demand (cross-platform) products, consolidations related to recent mergers, and increasing internal capabilities driven by modernizing facilities and increasing in-house manufacturing/test capabilities.