AEROSPACE & DEFENSE

Tier 1 Propulsion and Power

World's Most Productive Companies

Stability in Turbulence: The State of Tier 1 Power and Propulsion Providers

The A&D Tier 1 Power and Propulsion Peer Group provides comprehensive design, manufacture, and aftermarket support for large engines used in commercial and defense aircraft. They build and support jet engines, propulsion modules, auxiliary power units (APUs), and power generation systems. These firms combine deep vertical integration with significant R&D investment to serve the military and commercial aircraft OEMs and markets.

They have faced significant industry and market turmoil. Pandemic-driven demand collapse and recovery, supply chain fragility, raw material costs, regulatory scrutiny, program disruptions (such as Boeing’s 737 MAX challenges), and geopolitical disruptions impacted productivity for the peer group over the last six years. The sector’s move towards generating revenue through long-term service contracts, where customers pay a fixed fee per flight hour instead of purchasing the engine outright, has also presented additional challenges: MRO demand has fluctuated with the rise and fall of leisure and business travel.

In 2024, material and part bottlenecks persisted across the sector, limiting the positive impact of growing demand. Airframe production instability, particularly on the 737 MAX, led to planning inefficiencies and supply chain challenges.

Top 100 World's Most Productive Companies - Power and Propulsion Suppliers

Productivity Snapshot

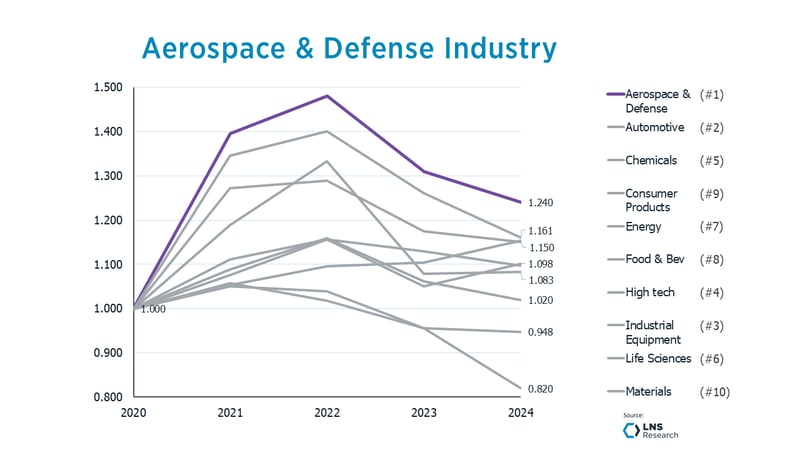

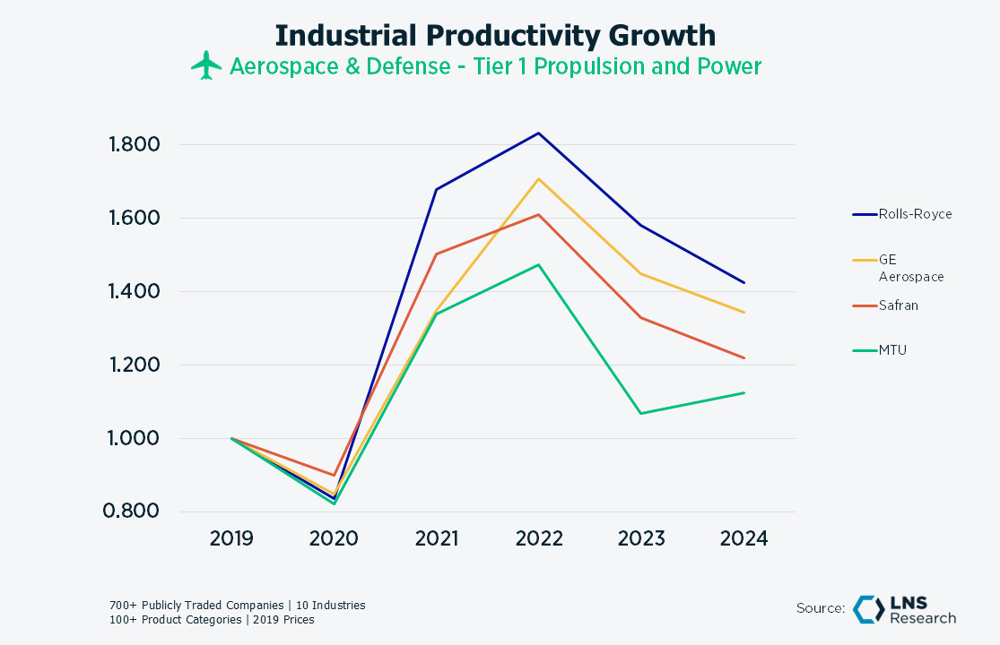

Despite the long-term nature of this market and changing business models, A&D Tier 1 Power and Propulsion Suppliers experienced a similar productivity trend to the rest of the A&D sector: a surge in productivity from 2020 to 2022, followed by a regression to declining productivity in 2023 and 2024. This Peer Group had some of the largest productivity growth of any group outside of high tech.

- Productivity in the sector increased by almost 27.7% over the last six years. This segment, like A&D generally, performed well above the average for manufacturers represented in the IPI, but has returned to stagnation and regression over the last two years.

- All these companies had negative productivity growth in 2023 and 2024.

- 2024 Productivity declined an average of 7.9% across these companies.

- Rolls-Royce earned its position within the LNS World’s Most Productive Companies by growing productivity 42.4% over the last six years, 11.5% more than its peers/competitors on average. Rolls-Royce's leading productivity performance is driven by a radical business transformation and restructuring program. This initiative streamlined operations, focused on digital innovation, and improved the durability and maintenance of its engines.