AEROSPACE & DEFENSE

Tier 1 Structural Suppliers

World's Most Productive Companies

Momentum and Challenges in Tier 1 Structures

The A&D Tier 1 Structural Suppliers are aerospace and defense suppliers that participate in global commercial and military aircraft programs, often with roles in engine, structures, actuation, avionics, and aftermarket services. They operate in long, interdependent supply chains anchored by the A&D OEMs, and are exposed to regulatory regimes, safety oversight, carbon policies such as CORSIA, and airline traffic cycles that drive OE and MRO demand. Recent years have seen a strong travel recovery and record passenger loads, surging demand for defense products, and increased scrutiny by regulators due to high-profile production quality issues.

Top 100 World's Most Productive Companies - Structural Suppliers

Productivity Snapshot

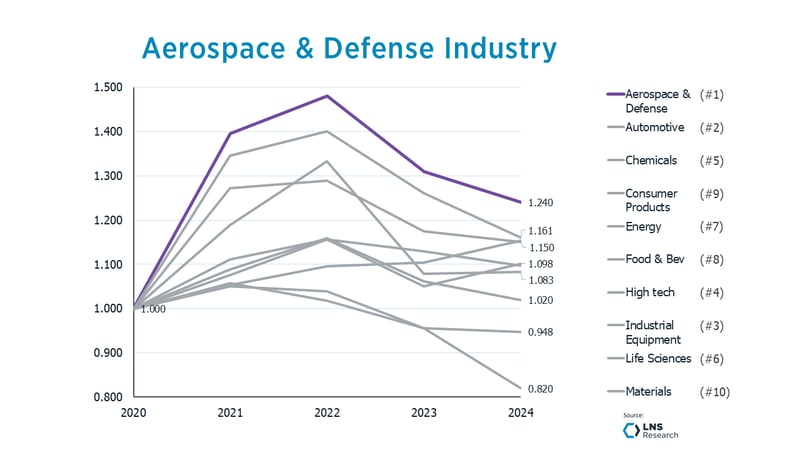

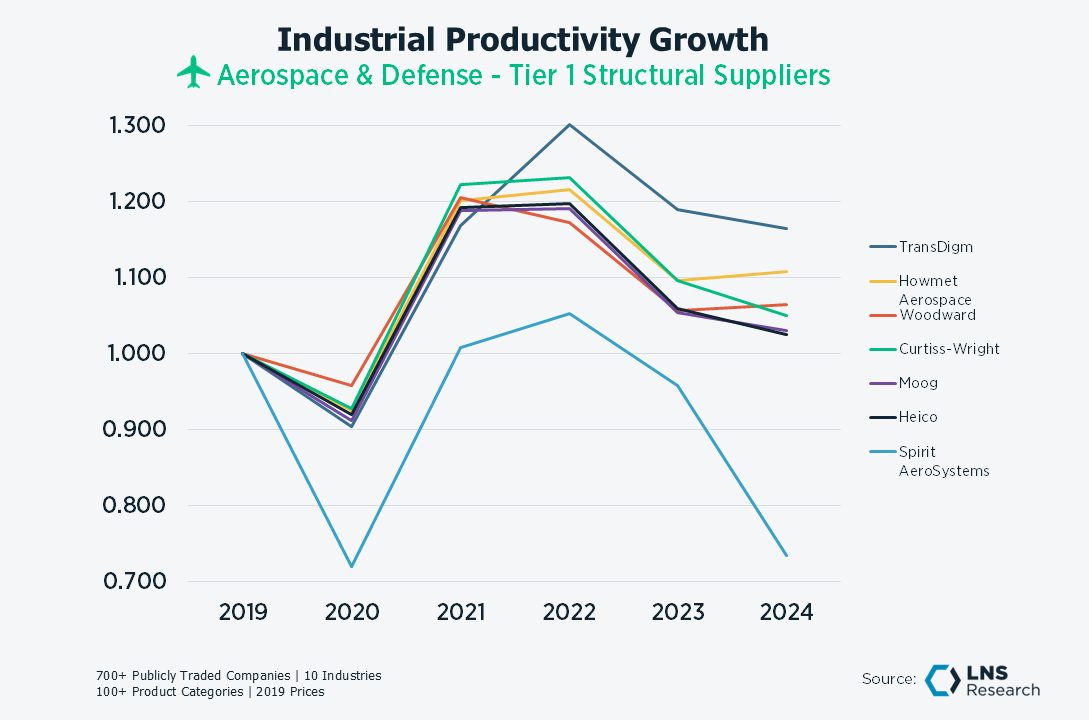

Despite the long-term nature of this market and these businesses, the Major A&D OEMs experienced a similar productivity trend to many other industries: a surge in productivity from 2020 to 2023, followed by a regression to declining productivity in 2023 and 2024.

- Productivity for the sector grew overall by only 2.4%, weighted down by the poor productivity performance of Spirit AeroSystems Holdings Inc., which showed a 26.5% decline over the last six years.

- The Peer Group, like A&D generally, performed well above the average for manufacturers represented in the IPI, but has returned to stagnation and regression over the last two years.

- Five of the seven companies experienced negative productivity growth in 2023 and 2024.

- 2024 Productivity declined an average of 4.8% across these companies.

- TransDigm Group earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity 16.4% over the last six years, which is more than five times its peers' average. TransDigm Group’s leading productivity performance is driven by the company’s value-driven operating model, decentralized decision-making, expansive aftermarket focus, and focused asset utilization.