CONSUMER PRODUCTS

Tobacco

World's Most Productive Companies

Reinventing Tobacco: RRPs as the New Growth Engine

These companies are all major global manufacturers and marketers of tobacco and nicotine products, including cigarettes, cigars, and increasingly, "Reduced Risk Products" (RRPs) such as heated tobacco, vapes, and oral nicotine pouches. They operate within a highly regulated industry facing secular decline in traditional combustible product volumes due to health awareness campaigns, stringent government regulations (e.g., plain packaging, advertising bans, excise taxes), and public smoking bans. A commonality is their strategic pivot towards RRPs as a core growth engine to offset the decline of conventional cigarettes. The companies share complex global supply chains for sourcing and processing tobacco leaves, as well as manufacturing facilities that are increasingly focused on automation and efficiency for both traditional and novel products. Their profitability relies on brand equity and pricing power in a mature market.

Productivity was impacted over the last six years by declining traditional product volumes, leading to lower capacity utilisation, operational disruptions and costs associated with shifting to RRP manufacturing, and increased administrative overhead due to complex regulations.

Top 100 World's Most Productive Companies - Tobacco

Productivity Snapshot

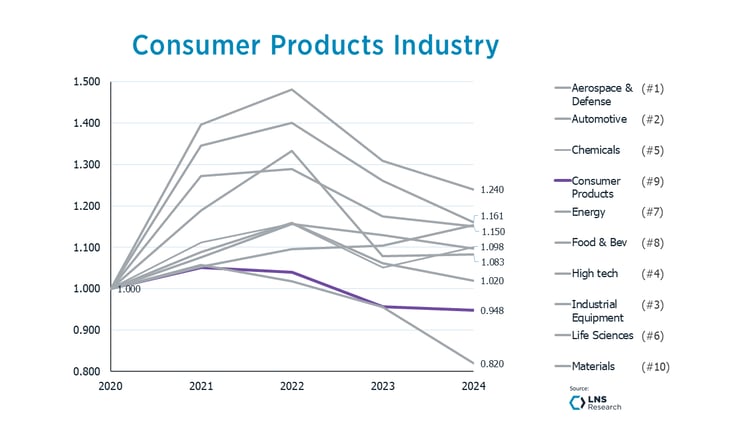

The Tobacco peer group has observed a distinct productivity trend over the past six years. Most other industries and peer groups experienced a surge in productivity from 2020 to 2023, followed by a regression to declining or stagnant productivity in 2023 and 2024. Tobacco saw a more linear and notable decline over those six years, with no “COVID bounce,” presumably because tobacco product demand drifted downward over that period and did not experience the dramatic increases and decreases associated with pandemic lifestyle changes.

- Productivity for the sector declined overall by 27.6% (or 5.5% per year) over the last six years. This segment, like Consumer Products generally, performed well below the average for manufacturers represented in the IPI.

- All these companies had negative productivity growth for the last six years, specifically in both 2023 and 2024.

- 2024 Productivity declined an average of 4.3% across these companies.

- Altria Group Inc. earned its position within the LNS 2025 World’s Most Productive Companies by realizing “only” a 14.3% productivity decline over the last six years, just under half of the average decline of its peers/competitors. Altria had the “best” productivity performance of the peer group over the last six years by executing a multi-year overhead reduction program to generate cumulative annual savings. The company streamlined operations, optimized manufacturing to align with declining volumes, and used technology for improved supply chain efficiency.