CONSUMER PRODUCTS

Recreation and Sporting Goods

World's Most Productive Companies

From Boom to Normalization in Sports, Outdoor, and Toy Manufacturing

The companies in this peer group are global manufacturers of sporting goods, outdoor recreation equipment, and toys, sharing complex supply chains, strong brand dependence, and a need for constant innovation. Their performance is closely tied to discretionary consumer spending, health, wellness, toy trends, and general macroeconomic conditions. Major influences included a pandemic-driven boom in demand for outdoor and home goods, followed by significant supply chain disruptions, high inflation, a build-up of excess inventory, and accelerating consumer demand for e-commerce and sustainable products.

Since 2019, these companies have navigated COVID disruption, a strong post-lockdown demand surge in sports, outdoor, and toys, followed by normalization with retailer destocking, inflation, high freight and labor costs, uneven regional recoveries, and trade and ESG-driven sourcing shifts.

Top 100 World's Most Productive Companies - Recreation and Sporting Goods

Productivity Snapshot

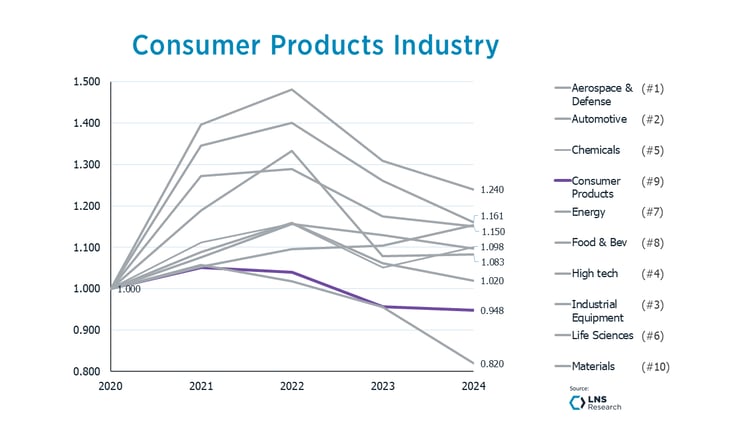

This peer group had uneven productivity performance. Most companies experienced a similar productivity trend to that of many other industries and peer groups: a surge in productivity from 2020 to 2023, followed by a regression to declining productivity in 2023 and 2024. The surge in productivity was typically greater than that of other manufacturers in the IPI, and the regression reflected a return to the mean in demand. A few companies, however, stood out by continuing or accelerating productivity growth in 2023 and 2024, and were very atypical among the 700 manufacturers of the IPI.

- Productivity for the sector grew overall by 21.6% (or 4.3% per year) over the last six years. This segment, unlike Consumer Products generally, performed significantly better than the average for manufacturers represented in the IPI.

- Six of the eight companies experienced negative productivity growth in 2023 and 2024.

- In 2024, Productivity declined an average of 2% across these companies.

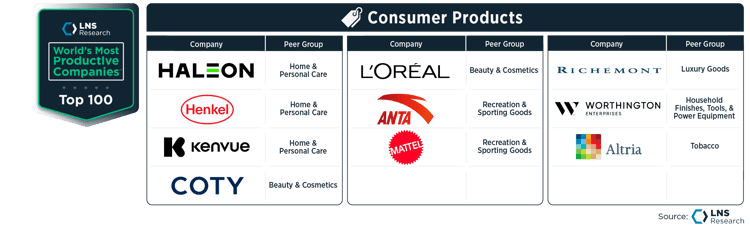

- ANTA Sports Products Ltd earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity 32.7% over the last six years, more than 51% above the average of its peers/competitors. ANTA Sports Products Ltd.'s leading productivity performance is driven by building a vertically integrated, multi-brand model (its "Single-Focus, Multi-Brand and Globalisation" strategy), shifting to higher-margin channels, investing in digital operations, and scaling with China’s participation boom.

- Mattel earned its position on the LNS 2025 World’s Most Productive Companies list by growing productivity faster than its regional/category peers over the last six years.