CONSUMER PRODUCTS

Luxury Goods

World's Most Productive Companies

Resilience and Volatility in Global Luxury

These companies are manufacturers and retailers of high-end fashion, accessories, cosmetics, and lifestyle goods, with a strong emphasis on brand prestige and exclusivity. They share a business model based on a strong brand heritage, exceptional craftsmanship, and significant vertical integration, spanning from manufacturing to exclusive distribution. Their performance is tied to global high-net-worth consumer spending and tourism.

Over the past six years, these luxury groups navigated a COVID-19 collapse and rebound, shifting Chinese and tourist demand, inflation and foreign exchange swings, travel retail disruptions, stronger jewelry and experiential categories, and rising expectations for climate, traceability, and social responsibility.

Top 100 World's Most Productive Companies - Luxury Goods

Productivity Snapshot

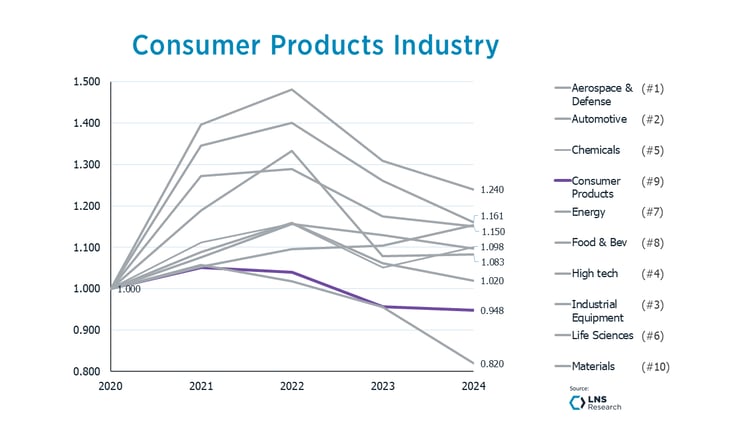

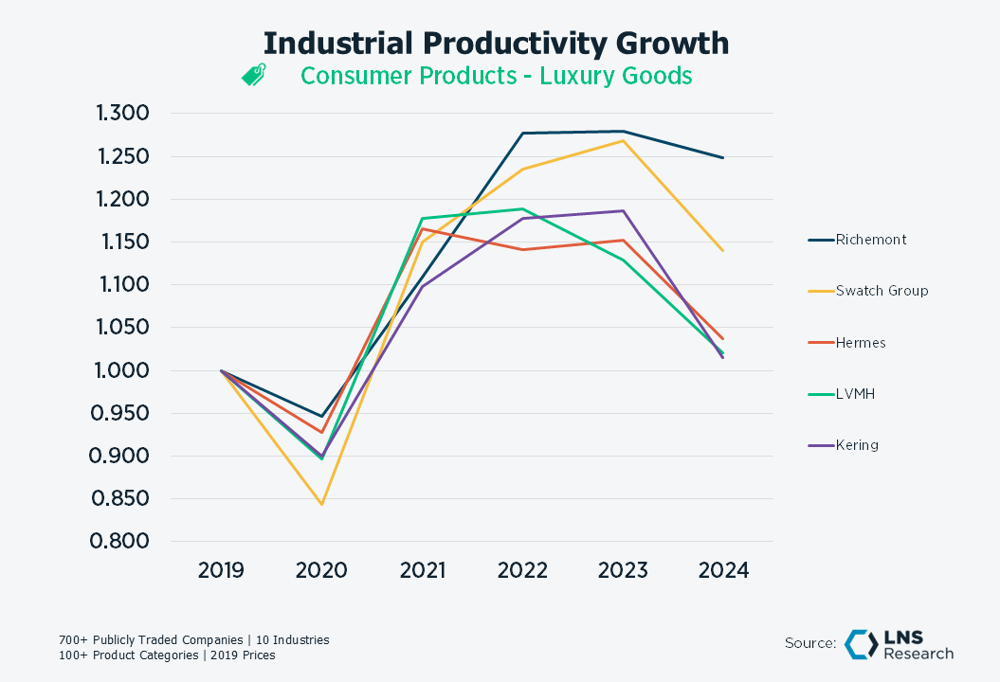

The Luxury peer group experienced a similar productivity trend to many other industries and peer groups: a surge in productivity from 2020 to 2023, followed by a regression to declining productivity in 2023 and 2024.

- Productivity for the sector grew overall by 9.2% (or 1.8% per year) over the last six years. This segment, like Consumer Products generally, performed well below the average for manufacturers represented in the IPI, and had less volatility in its productivity performance.

- All these companies had negative productivity growth in 2023 and 2024.

- 2024 Productivity declined an average of 11.1% across these companies – an average decline greater than most other peer groups.

- Richemont earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity 24.8% over the last six years, more than 2 and a half times the average of its peers/competitors. Richemont's leading productivity performance is driven by investment aimed at building resilience, ensuring a steady supply of high-quality products, and streamlining its operations.