Major OEMs & Defense Contractors

World's Most Productive Companies

Demand Surge Meets Operational Limits

Major A&D OEMs design, manufacture, and sustain complex aerospace and defense systems for government and commercial customers, operate within highly regulated export and safety regimes, and depend on long multiyear backlogs funded by national defense budgets or airline capital spending.

The peer group benefited over the last six years from a demand surge. Their order books and outlooks are tied to global defense expenditures, which rose sharply through 2019–2024, and to commercial air traffic, which has fully recovered from the pandemic.

In 2024, every company had negative productivity growth. Market changes may have simply overwhelmed the operations teams in these companies. On the defense side, demand spikes for munitions and air defense systems (Ukraine, Middle East, Indo-Pacific) outpaced plants’ ability to respond. Factories built for steady state procurement suddenly had to double or triple output—something not easily achievable in one year. Continued heightened regulatory oversight and stabilized, lower production rates, most visibly at Boeing after the January 2024 737-9 incident, limited throughput while quality systems were reset. Persistent, targeted supply chain bottlenecks, particularly engines, aerostructures, and cabin equipment, impacted a number of these companies.

Productivity Snapshot

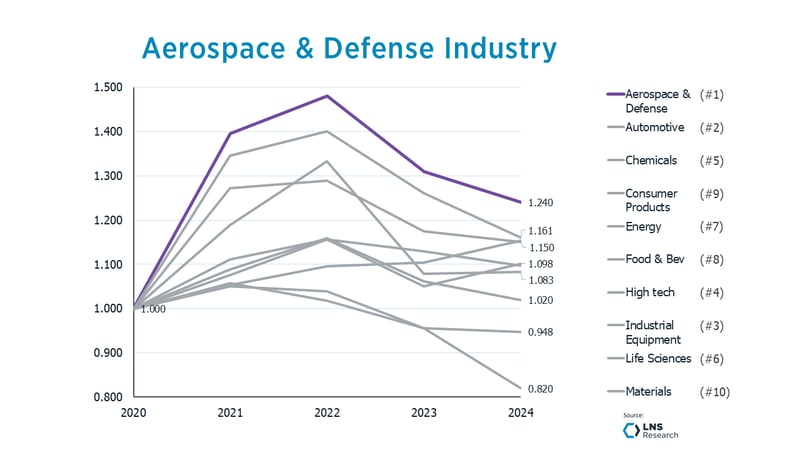

Despite the long-term nature of this market and these businesses, the Major A&D OEMs experienced a similar productivity trend to many other industries: a surge in productivity from 2020 to 2023, followed by a regression to declining productivity in 2023 and 2024.

- Productivity for the sector grew overall by 10.1% (or less than 2% per year) over the last six years. This Peer Group, like A&D generally, performed above the average for manufacturers represented in the IPI, but has returned to stagnation and regression over the last two years.

- All these companies had negative productivity growth in 2023 and 2024.

- 2024 Productivity declined by an average of 6% across these companies.

- Dassault Aviation earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity 87.4% more than the average of their peers/competitors over the last six years. Dassault Aviation’s leading productivity performance is driven by a focus on operational discipline, Lean, digital transformation, and design innovation.

- Northrop Grumman earned its position within the LNS 2025 World’s Most Productive Companies by growing productivity the most within North America and the most last year (by almost 1% while the rest of the sector regressed by 7%). Northrop Grumman productivity performance is influenced by its “Digital Pathfinder” transformation initiative and market driven growth.